The National Association of Sporting Goods Wholesalers’ SCOPE programs provide important, useful and, above all, accurate firearm industry sales information that can help retailers maximize profits. The three programs — SCOPE PLX, SCOPE DLX and SCOPE CLX — are part of an industry-owned, distributor-led initiative to collect and analyze data that strengthens shooting sports businesses.

“Distributors have taken the lead to create information that helps our industry grow,” says NASGW President Kenyon Gleason. “Through SCOPE’s data tools, retailers can better rely on their distributor partners to understand market trends and what that means for their business.”

SCOPE data currently comes directly from 20 wholesalers of firearms, ammunition, optics and accessories. With about 65% of gun sales flowing through this channel, the SCOPE information represents the largest data sample anywhere in the industry.

To help shooting sports retailers maximize profits, we’ll be doing a number of reports over the next several issues based on information available through SCOPE. Today we’ll start with some very important current sales trend information that can give retailers insight into what firearms can help drive sales and reduce stagnancy in their inventory.

Necessary Knowledge

For the very best, most accurate information available on any issue, it’s best to find the person who knows more about it than anybody else. When it comes to information garnered through the SCOPE programs, Tom Hopper, senior data analyst for NASGW, is that man.

Hopper says for retailers to make good decisions on inventory they must have a timely knowledge about what is going on in the industry.

“These are the trends of what's truly going on in the marketplace,” he says. “If I'm a gun dealer or a gun shop, I want to put my inventory dollars where I know it's going to sell. And these are the trends of what's selling.

“People need to really look at the facts, look at the numbers and understand what's going on. It's not that the market's bad. It's just the market is right sizing. Gun dealers are not dumb; they're very good with their dollars. So, they're trying to figure out, ‘How I can get rid of inventory without going bankrupt?’”

Retailers can find themselves in a quandary quickly by making poor inventory decisions. During the Covid pandemic, manufacturer prices went up because of supply chain problems. Now, manufacturers are charging distributors more for guns, and the distributors, in turn, have to pass the increased price on to retailers.

“Now, to get rid of inventory, retailers are marking it down,” Hopper says. “So, if retail prices are down and shipping prices for additional inventory are up, they physically can't buy as much. If I sell two guns, I can only buy one. So, it's kind of contrary to the supply and demand aspect. Even if I wanted to buy more, I physically can't because I'm having to sell a $700 shotgun for $600, but I'm having to buy back that $600 gun for $800.”

What’s Hot, What’s Not

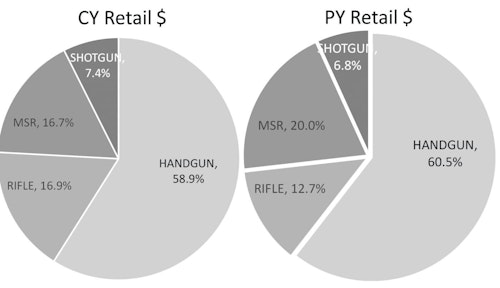

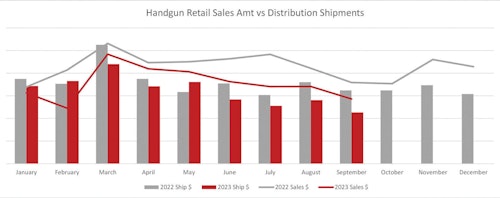

Two critical pieces of information concerning firearms sales are what types of guns are selling better or worse than last year, along with whether those guns are selling for more money or less compared to last year’s figures. Let’s take a look at these trends in a number of key categories.

Handguns are an interesting case study in the current phenomenon. While handgun sales are down 17% year over year, the average unit price is down 4%. Yet a deeper dive into handgun types reveals much more of the story.

“About 80% of all handgun sales are semi-automatics,” Hopper says. “So, the bulk of the handgun market is down and prices are down. But if you look at revolvers, sales are flat year over year, and the price is up 5% year over year.

“And you know what's interesting? It's not revolvers for concealed weapons that are selling so good. Consumers are buying more large-frame revolvers.”

An even deeper dive reveals which types of semi-autos are experiencing higher sales — therefore, are in higher demand — and which types are flat or floundering.

“Let’s look at four categories—pocket pistols, subcompacts, compacts and full-size,” Hopper says. “Pocket pistols are down 30% compared to last year, and prices are up 2%. Subcompacts are down almost 30% from last year with a price drop of 4%

“But the compact is flat and full size -3% year over year. Interestingly, your average unit price for all semi-auto pistols is down year over year, with full-size gun prices down 5%. So, when you look and the price is down and the sales dollars are down and sales units are down, they're selling more units. That means there’s a change in assortment or pricing.

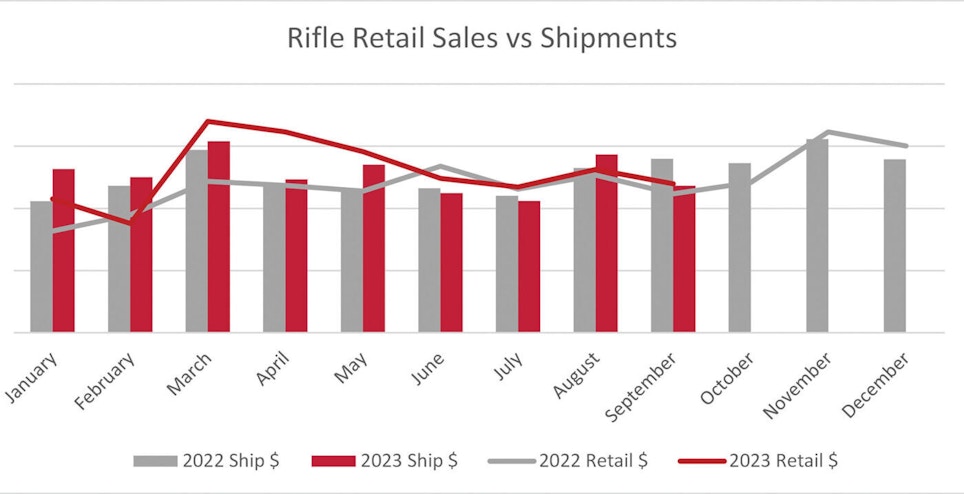

Rifles and Shotguns

Taking a deep dive into rifle sales also reveals important information for retailers making inventory decisions. The SCOPE programs have an individual category for Modern Sporting Rifles, including AR-style models, and the latest figures are interesting. Overall, at retail, MSRs are down 28%, but the AR portion of that is down 27% year over year and the prices are down 4%. So, the largest portion of that market is down. And from a distribution side it's been down 30+% for the past several months.”

The program divides other rifles into three main categories — bolt action, semi-automatic and lever action. Retail sales of the ubiquitous bolt action are up 10%, but the prices are down 1%. Sales of semi-automatic rifles are down 18%, but the retail prices are down almost 18%.

The big sleeper in the rifle market currently is the lever action. Prices on lever guns are up almost 12% and dollar sales are up 57%.

“What’s going on with lever guns is for the past two years, consumers haven't been able to find any. There's been a lot of pent-up demand. So now all of a sudden inventory is more readily available. And people are buying them up big time. Customers want the lever guns just because, you know, they’re fun and nostalgic.”

SCOPE data on shotgun sales can also help point the way for retailers wondering what to stock at this time and what to avoid. Shotguns as a whole are down 6%and the average retail is up 12%.

When you break it down, semi-automatics are down 2%with prices down 6%, but field guns are up 14%. Worth noting is the fact that last year tactical guns were 60% of the semi-automatic shotgun sales and field shotguns were 40%. This year it’s reversed with field semi-autos 47% of the sales.

“That means they've become a larger portion of the market and people are buying more field guns as a percent,” Hopper says. “So, the rate of sale on semiautomatic tactical guns has gone down. But what's interesting is the price has gone down on the tactical side, so all that's telling me is they're cleaning out some of the tactical gun inventory.”

Pump shotguns sales are down 19% year over year and prices are up 21%. Tactical pump-action guns were down 21% to last year, but prices are up 24% so tactical shotguns still have some importance. As for pump-action field shotguns, they’re down 7% year over year, and prices are up 14%.

Over/under double-barrel sales are up year over year 23% and prices are up 15%, but double guns make up a very small percentage of the shotgun market.

The Takeaway

All these sales and pricing trends paint a picture that can help retailers determine the best solution for buying firearms that they can sell at a good profit.

“I’m always telling people, buy what you need,” Hopper says. “Don't panic buy, and don't buy just because it's a good deal. It's a good deal when you buy it, but you're not selling it.

“So, really buy with caution based on productivity and what you need because things are always changing. I mean, if there's something new that happens in the market and you spend all your money, you probably can't afford to buy it. A lot of people get in trouble that way.”

The whole idea of the SCOPE program is to make everyone in the industry aware of the data available so members of the industry at all levels can work better together to make a good living.

“At the end of the day, we're actually here to help the distributors distribute more productively to the FFL and to the retailer,” Hopper says. “So, if we understand what the customer’s buying and we can pass that along to the distributor and to the manufacturer, then it becomes a win-win for everybody. The manufacturer makes what people want and they see the trends unfolding. So, they're making new products where we want to see them.

“Then it's all flowing through to the retailer, who's selling it to the customer. And it just gets to be a really nice, well-oiled machine. If everybody has information and can share the information, that's what we're after. It's providing the information so it's a win-win for everybody.”